import pandas as pd

from datetime import date

import numpy as np

from collections import OrderedDict

from dateutil.relativedelta import *

import matplotlib.pyplot as plt

from IPython.core.pylabtools import figsize

Build a payment schedule using a generator that can be easily read into a pandas dataframe for additional analysis and plotting

def amortize(principal, interest_rate, years, pmt, addl_principal, start_date, annual_payments):

"""

Calculate the amortization schedule given the loan details.

:param principal: Amount borrowed

:param interest_rate: The annual interest rate for this loan

:param years: Number of years for the loan

:param pmt: Payment amount per period

:param addl_principal: Additional payments to be made each period.

:param start_date: Start date for the loan.

:param annual_payments: Number of payments in a year.

:return:

schedule: Amortization schedule as an Ortdered Dictionary

"""

# initialize the variables to keep track of the periods and running balances

p = 1

beg_balance = principal

end_balance = principal

while end_balance > 0:

# Recalculate the interest based on the current balance

interest = round(((interest_rate/annual_payments) * beg_balance), 2)

# Determine payment based on whether or not this period will pay off the loan

pmt = min(pmt, beg_balance + interest)

principal = pmt - interest

# Ensure additional payment gets adjusted if the loan is being paid off

addl_principal = min(addl_principal, beg_balance - principal)

end_balance = beg_balance - (principal + addl_principal)

yield OrderedDict([('Month',start_date),

('Period', p),

('Begin Balance', beg_balance),

('Payment', pmt),

('Principal', principal),

('Interest', interest),

('Additional_Payment', addl_principal),

('End Balance', end_balance)])

# Increment the counter, balance and date

p += 1

start_date += relativedelta(months=1)

beg_balance = end_balance

Wrapper function to call amortize.

This function primarily cleans up the table and provides summary stats so it is easy to compare various scenarios.

def amortization_table(principal, interest_rate, years,

addl_principal=0, annual_payments=12, start_date=date.today()):

"""

Calculate the amortization schedule given the loan details as well as summary stats for the loan

:param principal: Amount borrowed

:param interest_rate: The annual interest rate for this loan

:param years: Number of years for the loan

:param annual_payments (optional): Number of payments in a year. DEfault 12.

:param addl_principal (optional): Additional payments to be made each period. Default 0.

:param start_date (optional): Start date. Default first of next month if none provided

:return:

schedule: Amortization schedule as a pandas dataframe

summary: Pandas dataframe that summarizes the payoff information

"""

# Payment stays constant based on the original terms of the loan

payment = -round(np.pmt(interest_rate/annual_payments, years*annual_payments, principal), 2)

# Generate the schedule and order the resulting columns for convenience

schedule = pd.DataFrame(amortize(principal, interest_rate, years, payment,

addl_principal, start_date, annual_payments))

schedule = schedule[["Period", "Month", "Begin Balance", "Payment", "Interest",

"Principal", "Additional_Payment", "End Balance"]]

# Convert to a datetime object to make subsequent calcs easier

schedule["Month"] = pd.to_datetime(schedule["Month"])

#Create a summary statistics table

payoff_date = schedule["Month"].iloc[-1]

stats = pd.Series([payoff_date, schedule["Period"].count(), interest_rate,

years, principal, payment, addl_principal,

schedule["Interest"].sum()],

index=["Payoff Date", "Num Payments", "Interest Rate", "Years", "Principal",

"Payment", "Additional Payment", "Total Interest"])

return schedule, stats

Example showing how to call the function

df, stats = amortization_table(700000, .04, 30, addl_principal=200, start_date=date(2016, 1,1))

stats

Payoff Date 2042-12-01 00:00:00

Num Payments 324

Interest Rate 0.04

Years 30

Principal 700000

Payment 3341.91

Additional Payment 200

Total Interest 444406

dtype: object

df.head()

| Period | Month | Begin Balance | Payment | Interest | Principal | Additional_Payment | End Balance | |

|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 2016-01-01 | 700000.00 | 3341.91 | 2333.33 | 1008.58 | 200.0 | 698791.42 |

| 1 | 2 | 2016-02-01 | 698791.42 | 3341.91 | 2329.30 | 1012.61 | 200.0 | 697578.81 |

| 2 | 3 | 2016-03-01 | 697578.81 | 3341.91 | 2325.26 | 1016.65 | 200.0 | 696362.16 |

| 3 | 4 | 2016-04-01 | 696362.16 | 3341.91 | 2321.21 | 1020.70 | 200.0 | 695141.46 |

| 4 | 5 | 2016-05-01 | 695141.46 | 3341.91 | 2317.14 | 1024.77 | 200.0 | 693916.69 |

df.tail()

| Period | Month | Begin Balance | Payment | Interest | Principal | Additional_Payment | End Balance | |

|---|---|---|---|---|---|---|---|---|

| 319 | 320 | 2042-08-01 | 14413.65 | 3341.91 | 48.05 | 3293.86 | 200.0 | 10919.79 |

| 320 | 321 | 2042-09-01 | 10919.79 | 3341.91 | 36.40 | 3305.51 | 200.0 | 7414.28 |

| 321 | 322 | 2042-10-01 | 7414.28 | 3341.91 | 24.71 | 3317.20 | 200.0 | 3897.08 |

| 322 | 323 | 2042-11-01 | 3897.08 | 3341.91 | 12.99 | 3328.92 | 200.0 | 368.16 |

| 323 | 324 | 2042-12-01 | 368.16 | 369.39 | 1.23 | 368.16 | 0.0 | 0.00 |

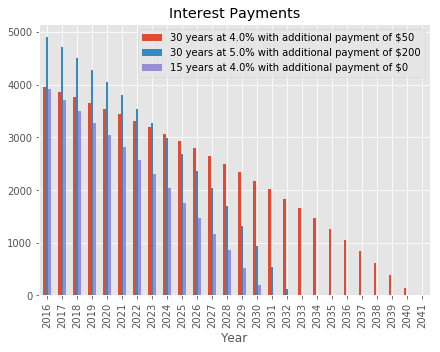

Make multiple calls to compare scenarios

schedule1, stats1 = amortization_table(100000, .04, 30, addl_principal=50, start_date=date(2016,1,1))

schedule2, stats2 = amortization_table(100000, .05, 30, addl_principal=200, start_date=date(2016,1,1))

schedule3, stats3 = amortization_table(100000, .04, 15, addl_principal=0, start_date=date(2016,1,1))

pd.DataFrame([stats1, stats2, stats3])

| Payoff Date | Num Payments | Interest Rate | Years | Principal | Payment | Additional Payment | Total Interest | |

|---|---|---|---|---|---|---|---|---|

| 0 | 2041-01-01 | 301 | 0.04 | 30 | 100000 | 477.42 | 50 | 58441.08 |

| 1 | 2032-09-01 | 201 | 0.05 | 30 | 100000 | 536.82 | 200 | 47708.38 |

| 2 | 2030-12-01 | 180 | 0.04 | 15 | 100000 | 739.69 | 0 | 33143.79 |

Make some plots to show scenarios

%matplotlib inline

plt.style.use('ggplot')

fig, ax = plt.subplots(1, 1)

schedule1.plot(x='Month', y='End Balance', label="Scenario 1", ax=ax)

schedule2.plot(x='Month', y='End Balance', label="Scenario 2", ax=ax)

schedule3.plot(x='Month', y='End Balance', label="Scenario 3", ax=ax)

plt.title("Pay Off Timelines");

def make_plot_data(schedule, stats):

"""Create a dataframe with annual interest totals, and a descriptive label"""

y = schedule.set_index('Month')['Interest'].resample("A").sum().reset_index()

y["Year"] = y["Month"].dt.year

y.set_index('Year', inplace=True)

y.drop('Month', 1, inplace=True)

label="{} years at {}% with additional payment of ${}".format(stats['Years'], stats['Interest Rate']*100, stats['Additional Payment'])

return y, label

y1, label1 = make_plot_data(schedule1, stats1)

y2, label2 = make_plot_data(schedule2, stats2)

y3, label3 = make_plot_data(schedule3, stats3)

y = pd.concat([y1, y2, y3], axis=1)

figsize(7,5)

fig, ax = plt.subplots(1, 1)

y.plot(kind="bar", ax=ax)

plt.legend([label1, label2, label3], loc=1, prop={'size':10})

plt.title("Interest Payments");

additional_payments = [0, 50, 200, 500]

fig, ax = plt.subplots(1, 1)

for pmt in additional_payments:

result, _ = amortization_table(100000, .04, 30, addl_principal=pmt, start_date=date(2016,1,1))

ax.plot(result['Month'], result['End Balance'], label='Addl Payment = ${}'.format(str(pmt)))

plt.title("Pay Off Timelines")

plt.ylabel("Balance")

ax.legend();